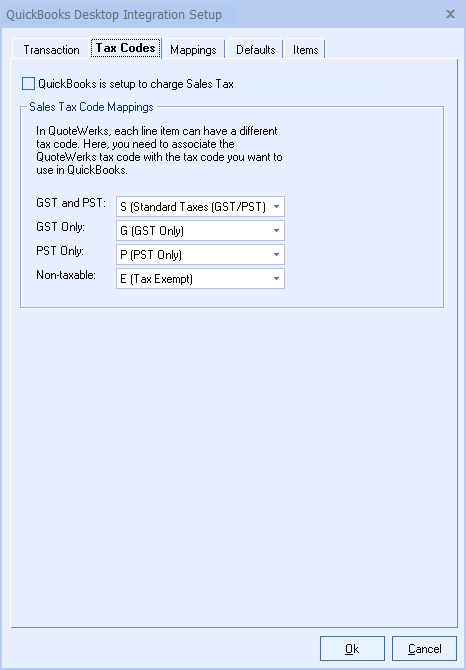

QuickBooks is setup to charge Sales Tax

Check this box if you collect or charge sales tax in QuickBooks.

Sales Tax Code Mappings

Each line item in a QuoteWerks document has a QuoteWerks tax code associated with it.

When exporting estimates/invoices to QuickBooks you will need to specify the QuickBooks tax code that matches each of the QuoteWerks tax codes.

Special Notes on Tax Code Mapping

On the Tax Codes tab in the QuoteWerks QuickBooks link setup you need to match up the QuoteWerks tax code B, G, P, and N with corresponding tax codes that are setup in QuickBooks.

In QuoteWerks you setup the GST tax rate on the Regional tab of the Tools -> Options menu. This GST tax rate is applied to all quotes (orders and invoices too) unless on the quote you select the “GST tax exempt” option. The PST tax rate in QuoteWerks is specified on each quote on the Sale Info tab. You can set the default PST tax rate for all new quotes on the Documents tab of the Tools -> Options menu.

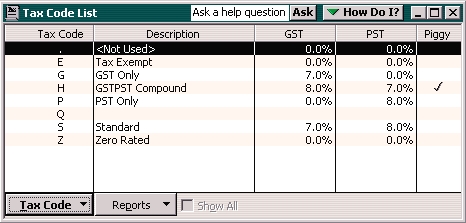

In QuickBooks, you setup the tax codes by selecting the Lists -> Tax Codes menu in QuickBooks:

In QuickBooks, for each tax code, you specify a GST and PST tax rate. You need to make sure that the tax codes in QuoteWerks that are mapped to the tax codes in QuickBooks have the same GST and PST tax rates. If they do not, you will find that when the quote is exported to QuickBooks, the GST and PST calculated amounts will be different than the amounts calculated in QuoteWerks.

For information on the next tab, see Mappings Tab.

Related Topics: