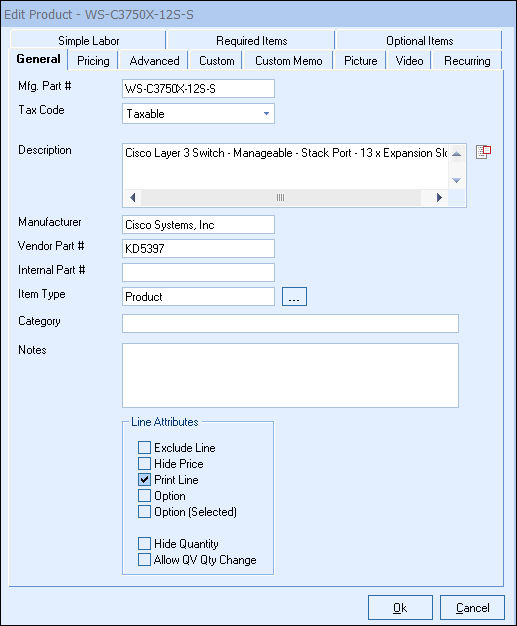

The following describes the use of the key fields on the General tab.

The manufacturer part number is the key field that is necessary for most of QuoteWerks’ more advanced features. It is used in several ways:

•Comparing products from different vendors that are in different product databases.

•Used to reference the product when creating bundles and configurations.

•Used to reference the product when looking for Substitutions.

•Used to reference the product when looking for Requirements.

•Used to reference the product when looking for Options.

•Used to retrieve item when using Quick Lookup tool bar.

•Used to print pictures and spec sheets.

Ideally, a manufacturer part number is a short, simple alpha-numeric value that uniquely identifies an item. We recommend that manufacturer part numbers only contain letters and/or numbers. Punctuation in a part number like spaces, commas, apostrophes, quote symbols, etc. are not recommended. The vendor part number is the part number that your vendor uses and that you use to order the product.

|

Tax Code

Certain products are taxable and some are not. Services for example are typically not taxable. On the Edit Product window, you can explicitly set the taxability of the product.

When new products are manually created in the product database by clicking on the [New] button, the tax code will default to the setting that you have specified under the Document Items tab of the Tools -> Options menu.

When new blank line items are added to the quote, the default line item taxable status will be determined by the setting on the Quote Items tab of the Tools -> Options menu.

|

Description

The QuoteWerks product description can be 32,000 characters in length. If your product descriptions have multiple lines, you can double-click in the description box or click the  button to display a window with a large area to edit your description. You can press the F7 key to run spell check on the description from this window.

button to display a window with a large area to edit your description. You can press the F7 key to run spell check on the description from this window.

Manufacturer

The manufacturer is used to store the name of the manufacturer of the selected item. The manufacturer and vendor can be the same name.

Item Type

Click on the  button or F2 to launch the list of item types for this item. You can Add, Edit or Delete other item types from this option list. The item type is a good field to use for classifying and/or categorizing an item. This item type field is also copied into the quote when the item is added to the quote. Because of this, this is a good field to store item type information in when you know that you will want to create reports based on the item type information in quotes. Examples of items types include; Product, Service, Labor, Warranty, etc..

button or F2 to launch the list of item types for this item. You can Add, Edit or Delete other item types from this option list. The item type is a good field to use for classifying and/or categorizing an item. This item type field is also copied into the quote when the item is added to the quote. Because of this, this is a good field to store item type information in when you know that you will want to create reports based on the item type information in quotes. Examples of items types include; Product, Service, Labor, Warranty, etc..

Category

This field is used to more narrowly identify an item. The Product Lookup window allows you to search on this field. Examples of categories may include; Software, Hardware, Licenses, Annual, Semi-Annual, etc.

Notes

This field allows you to add special notes regarding the product. These notes will be copied into the notes column for the product when it is added to the quote.

Line Attributes

The default line attributes for a product can be set here. These will be the default settings when pulling this item into your quote. When using this product in a bundle, configuration, optional, or required item definition, the attributes defined in those entities will overwrite the product level attributes.